Unlike B2B customers that typically have their tax rate set in the ERP, B2C customers don’t have their own ERP account to inform the website of the correct taxes. As such, we use surrogate accounts set up in the ERP that the website can be configured to refer to and calculate the taxes correctly.

This method is appropriate for many countries. However, the lowest level that we can hold taxes are at the State or Province level. If you are in the US, shipping a lot of B2C orders within the US, we strongly suggest integrating with Avalara.

In the US, each state and county determines whether taxes on products and shipping charges should apply for online orders, as well as the tax rates. There are about 10,000 jurisdictions in the US. For US webstores, these links may provide some useful information:

Set Up

In this example we’ll set up the taxes for a company based in Canada that ships worldwide.

Your System Default Customer will be set up with no tax rate applied to it — we can’t apply any taxes until we know where the order is being shipped to.

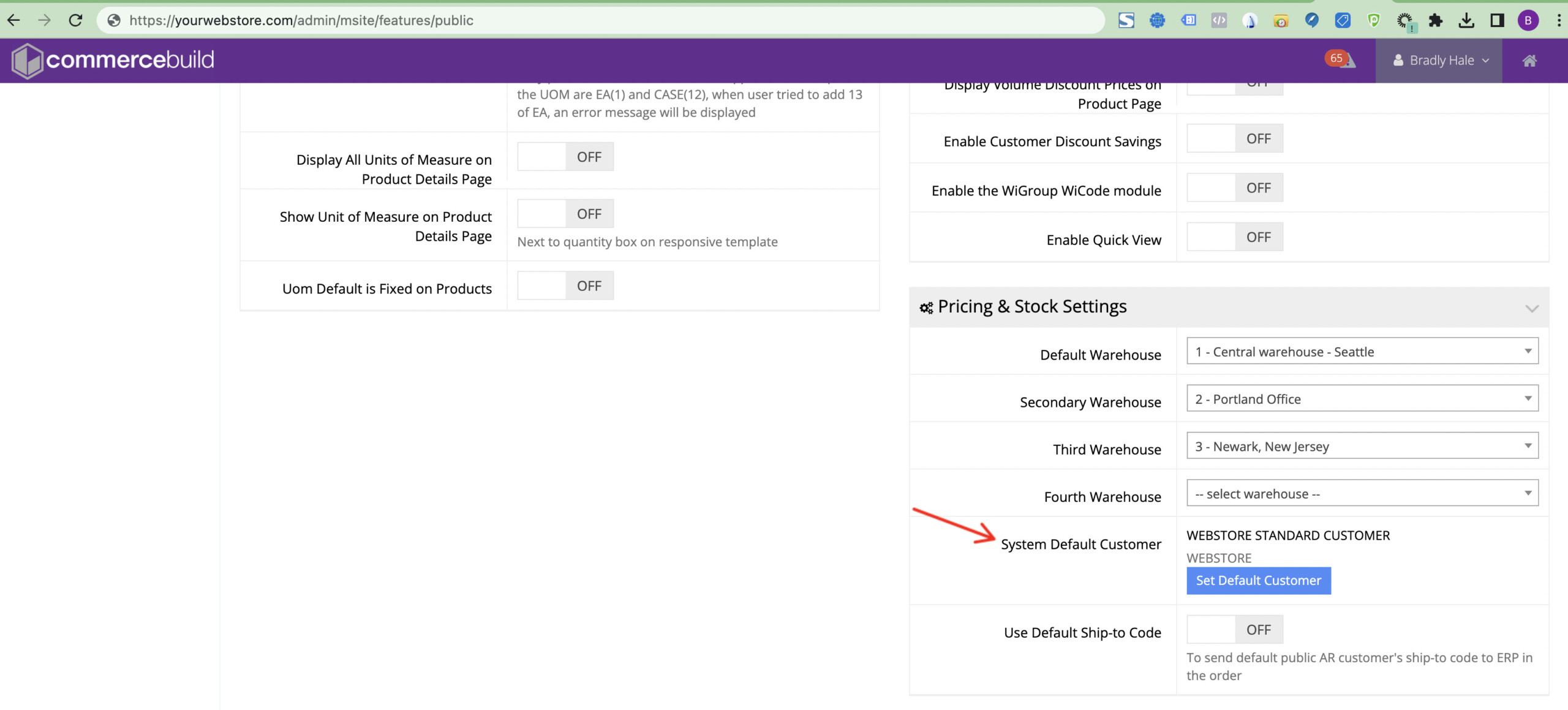

Your System Default Customer may look something like WEBSTORE Webstore Standard Customer when you navigate to System > Features > B2C (Public):

WEBSTORE will be an account in the ERP, with no taxes, and associated with the correct retail pricelist. If the customer’s address doesn’t match any of the following accounts, then this is the default and no taxes are charged.

Per province/state

Create a B2C webstore AR Customer account in the ERP for each province and territory. Accounts set this way may look like:

WEBAB Webstore Alberta

WEBBC Webstore British Columbia

WEBMB Webstore Manitoba

WEBNB Webstore New Brunswick

WEBNL Webstore Newfoundland and Labrador

WEBNT Webstore Northwest Territories

WEBNS Webstore Nova Scotia

WEBNU Webstore Nunavut

WEBON Webstore Ontario

WEBPE Webstore Prince Edward Island

WEBQC Webstore Quebec

WEBSK Webstore Saskatchewan

WEBYK Webstore Yukon

Setting the webstore to automatically switch to the appropriate AR Customer

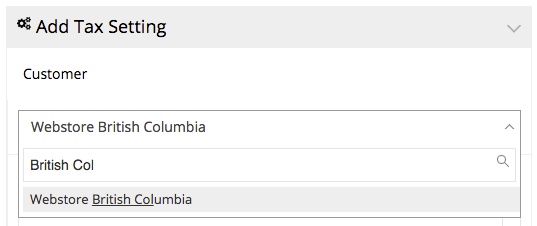

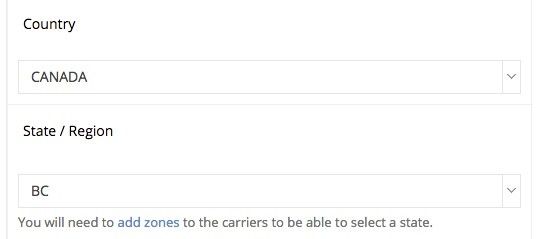

To configure your webstore to switch to the appropriate AR Customer in the webstore checkout after a B2C user has entered their ship to state/province, you must configure your B2C Tax Settings. Note that the available “state/region” will be pulled directly from your shipping zones for the country. Consequently, if a state/province is not available to select, check your shipping setup to ensure that the state/province has been created as a shipping zone.

First, navigate to System > Tax Setting in the eCommerce Console.

1) Select a tax AR Customer account in the Customer dropdown menu

2) Select a Country and State/Region

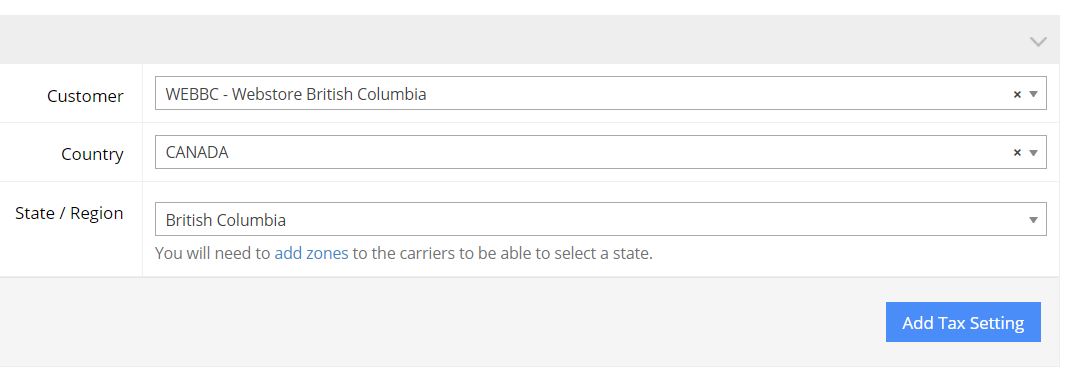

Once a B2C user selects their country and state/province/region during the checkout, if it matches the fields you enter here, your webstore will automatically switch to the AR Customer and apply the associated AR Customer account to the order, therefore applying its tax settings too.

Your page should look something like this:

3) Don’t forget to Click Add Tax Setting

You’ve set up a region! Repeat for all the regions.

When configured correctly, the webstore will follow the tax setup configured in the ERP.

Sales tax is applied to shipping charges in Canada, for example. Other countries/states/regions may have different rules.

In Canada :

Item @ $35

Shipping @ $10

Total = $45

Tax would be $5.40 to ship to BC (12%)

Tax would be $5.85 to ship to ON (13%)

Tax would be $4.95 to ship to SK (11%)